When the future looks a bit uncertain – get some professional advice

23rd November 2020

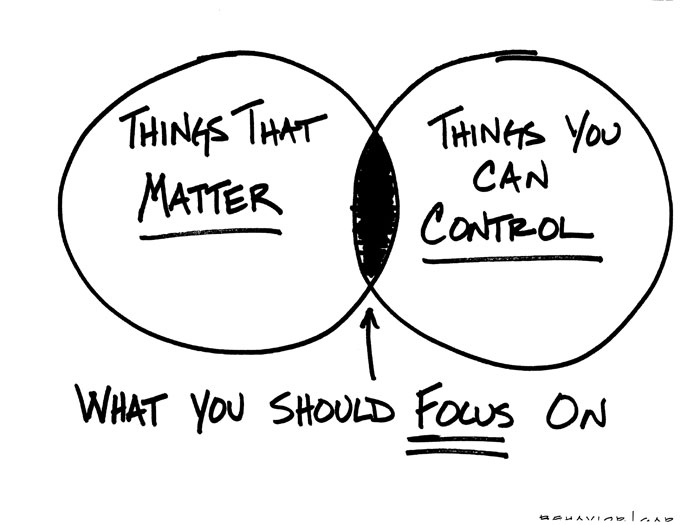

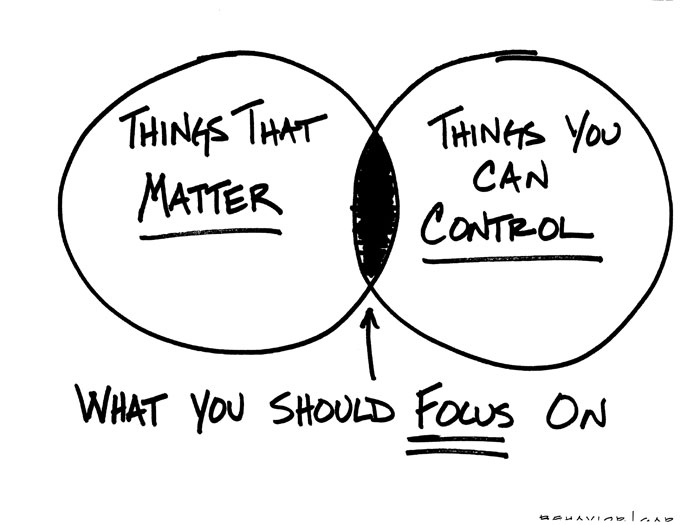

Sometimes the planets align for no apparent reason but that seems to be happening right now at RobMac. We published an article recently about what makes RobMac different which looked at the “behaviour gap”.

It seemed to strike a chord with people and we received some very positive feedback about how it helped to make sense of financial planning and the role that we as advisers can play.

At the same time, the media (the FT, the Times, the Guardian, Which and even Money Savings Expert) have also been urging people to take financial advice during these uncertain times rather than looking at short term solutions.

So, if we at RobMac are saying it and the media are saying it, then it must be true!

But we thought it might be more persuasive if we explained why it’s a good idea.

There are lots of illustrations and tales of woe that have occurred in the last year. For example, it is estimated that the average value of a pension fund fell by 15% in the first quarter of 2020. This is the worst quarterly performance on record surpassing the global financial crisis of 2008.

What did this mean for an individual? Well, for someone who had a pension fund of £41,000, then they would receive £1,660 per annum which is down 19% from the start of the year. Not surprising therefore that some people reacted either by stopping putting money towards their pension or by cashing in on their investments.

Roll forward to October and the stock market has recovered to only being 5% down since the March low point. While most experts agree that the economy is not going to bounce back as quickly as initially hoped, the recent news about Covid vaccines has sent stock markets soaring around the world.

In a few short months investment values, while volatile, are likely return to their previous values and hopefully continue to increase in the future.

Which is why we always advise our clients to take a medium to long term view to their investments.

People who cashed in their pension in March did so at the bottom end of the market and will now take years to try and claw back that investment value 8 months later.

This knee jerk reaction has since caused the FCA to tighten the rules around pension transfers and have introduced new measures as 1st October this year.

You really do now need to talk to an adviser when considering the options for your pension.

One other aspect of seeking financial advice has changed too. The Retail Distribution Review of 2006 shook up the financial advice marketplace. One area of concern was where independent financial advisers were selling products that gave them the most commission rather than being the best vehicle for their clients. Because it was a commission-based model, they didn’t charge for their advice. As a result, consumers had lost confidence and trust with financial institutions.

Since 2012, independent financial advisers now charge for their recommendations. For some, this was a difficult transition and many dropped out of the marketplace. In addition, clients who were used to receiving advice for free now had to pay which also drove them away from seeking help.

If we look at the situation today, clients understand the importance of independent financial advice and appreciate the value in being recommended solutions that are right for them (and not the adviser).

Typically, any initial consultation with an IFA is free and that helps both parties establish whether the adviser is right for the client and equally whether the client needs help from the adviser or not. If the relationship is taken to the next step, then costs are outlined so that the client can make up their mind on whether to proceed or not.

As we explained in our article What Makes RobMac Unique?, we believe that we understand the needs and aspirations of our clients partly because we have been advising clients for over 25 years and partly because we share those needs and aspirations too. The difference is that we immerse ourselves in the financial world and so understand what the options are; when the law changes; what new products are available and then discuss them internally and if appropriate with our clients too.

So, if you are interested in learning about what makes RobMac different and think that we can help, then please get in touch. If you would like to discuss your financial position or mortgage further, you can arrange to meet either face to face or online with one of our financial advisers by scheduling a meeting here >>