What Makes RobMac Unique?

4th November 2020

The recent disruption to our usual business routine has at least allowed for some deep thinking and introspection here at RobMac. We know that we provide an excellent service to our clients whether it’s on investment, pensions, financial planning or mortgages – but everyone says that. We know that nearly all our clients stay with us over the long term – but everyone says that too.

So, what does RobMac do that makes us different from all the other financial advisers out there?

Well we crunched the numbers to see if that would give us an answer and we found some interesting facts:

- 95 % of our financial advice clients have been with us for 5 years or more

- 80% of all pension & investment clients have been referred to us by existing clients, solicitors and accountants

- Over 50% of our clients are women

- 50% of our new mortgages are referrals from existing clients and 80% of our mortgage clients come back to us for further advice

Interesting those these numbers were, it didn’t really answer the question on what makes us different.

So, we looked at other aspects too:

Was it because we were based in city centre Edinburgh with its reputation for excellent financial services? Well, we think it’s a factor, but our clients come from all over the UK.

Was it our communication strategy of commenting on financial and housing issues on a regular basis? Certainly, the stats on visits to our website, our social media engagement and the online bookings would suggest it helps but it isn’t at the core of what makes us different.

We then went back to what we always do and started looking at it from a client’s viewpoint. We realised it’s because we understand the financial issues facing our clients. That’s because our advisors are a mix of men and women of all ages who have experience of the same issues. Let’s face it, we all worry about money.

We need to plan for life after work and how to best manage our pension fund. Or perhaps to free up some cash to help educate our children (school fees or university). Or mortgage advice whether we’re a first-time buyer or looking to remortgage. We understand the same issues as our clients.

The only difference between ourselves and our clients and is that we immerse ourselves in the financial world. And when we’re not speaking to clients, we spend our time looking at investments, discussing planning ideas, understanding risk and generally keeping up to date with financial matters.

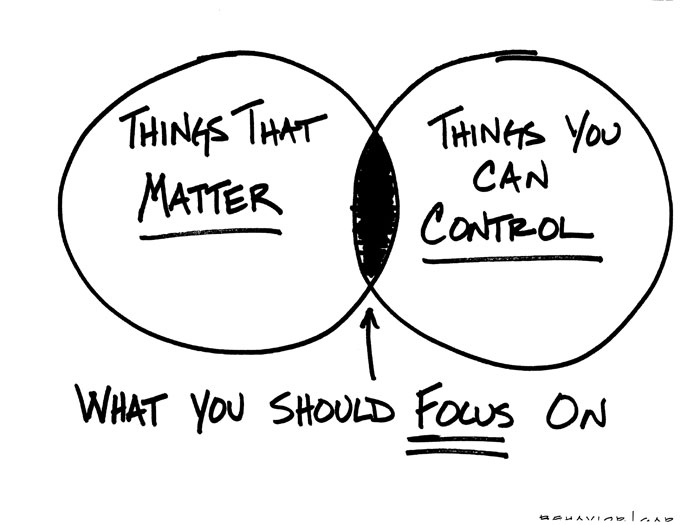

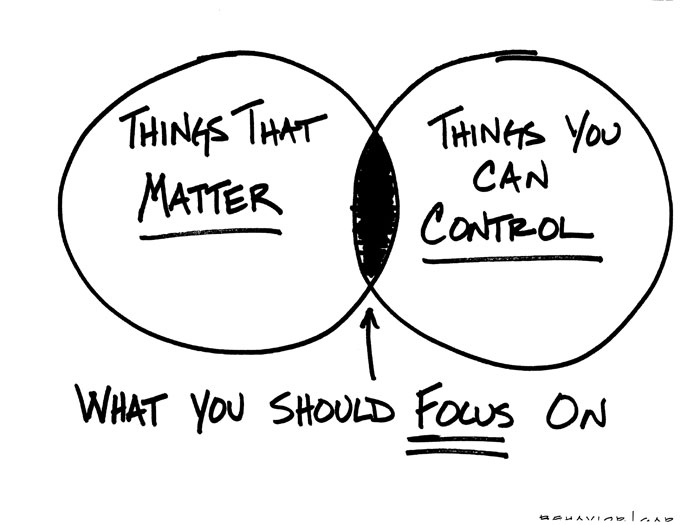

Our next step was to articulate that in a meaningful way so that people easily understood what makes RobMac different which is when we came across the Behaviour Gap. It’s a simple theory but we think it perfectly sums up what we do.

The things that matter to our clients (and us too) are our aspirations of what we believe our lives should look like. And that will be different for everyone. For some it might be the proverbial yacht in the Caribbean whereas for others it might be to leave a significant inheritance. Buying property in a good area for schools might be the priority at that stage of their lives whereas for others it might be about staying in their family home and not downsizing when they retire. It’ll be different for everyone.

Equally the things you can control will also be different for everyone. The amount that people choose to save may well be determined by their salary or the amount of their mortgage. They may already have an existing pension from a previous employer and need advice. The point is that they can control these variables and use them to influence the things that matter to them.

And the point of the diagram is where the things that matter meet with the things you can control is what you should focus on. That’s where RobMac can help. We can provide our clients with advice to make sure that they are in charge of what’s important to them.

We make sure that the two circles overlap and that there are no surprises lurking in the future. Because we understand the same issues that our clients face and because we have access to financial and mortgage solutions coupled with over 25 years of experience, it allows us to offer our clients the right advice for their situation.

If you are interested in learning about what makes RobMac different and think that we can help, then please get in touch. If you would like to discuss your financial position or mortgage further, you can arrange to meet either face to face or online with one of our financial advisers by scheduling a meeting here >>