6 ways to lose your home – the one key takeaway from a recent Legal & General seminar on income protection

12th March 2020

Lisa Doig and Alison Mitchell recently attended a seminar on income protection run by Legal & General. While the seminar covered a wide range of income protection topics, the one that had the most impact was just how easy it is to potentially lose your home.

And when you see the 6 reasons below, it’s even more pertinent in the current uncertain environment with the recent storms and the Coronavirus pandemic.

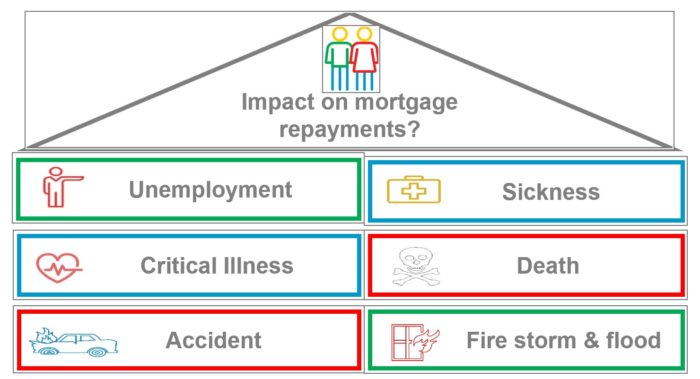

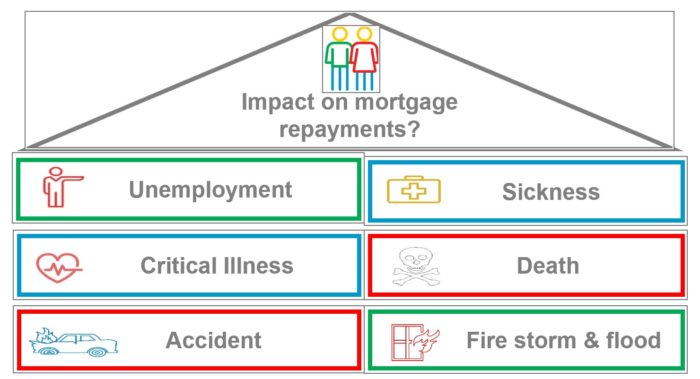

6 Ways to lose your home

So while we all are required to take out insurance on our buildings and contents when we take out a mortgage, there is no legal requirement to protect the person(s) that are paying the mortgage. As you can see from above, nearly all of the above can be insured separately with life cover and income protection.

Many companies do offer death in service and sick pay benefits but for the self employed there are no such safety nets.

With not too much imagination, it’s easy to see how some of the above could come into play should the Coronavirus situation escalate.

A common misconception is that life cover and insurance protection are expensive policies. A decade ago this was true, but over the last 10 years the policies have evolved and become more flexible, resulting in lower cost premiums.

In addition, the main players are now looking to pay out on claims rather than look for reasons not to.

Alison Mitchell commented that “Protection is largely overlooked by clients for one reason or another. I see it as a choice; giving you the choice to do what you want, when you want, at a time when everything around you may be falling apart. It’s a way to keep in control of your life when illness or maybe even death has taken that control away.”

Lisa Doig went on to say “Many clients are unaware that this type of cover is available. Once they start to consider how serious an impact it could have, for example if they could never work again – then they want peace of mind that they could look after the home and family”.

If any of the above is of interest to you and you would like to discuss your financial position further, you can arrange to meet with one of our financial advisers by scheduling a meeting here >>